Ever wished your unwashed dishes or unfolded laundry could magically transform into your child's Roth IRA contributions?

Well, grab your phone because that wild dream just became reality!

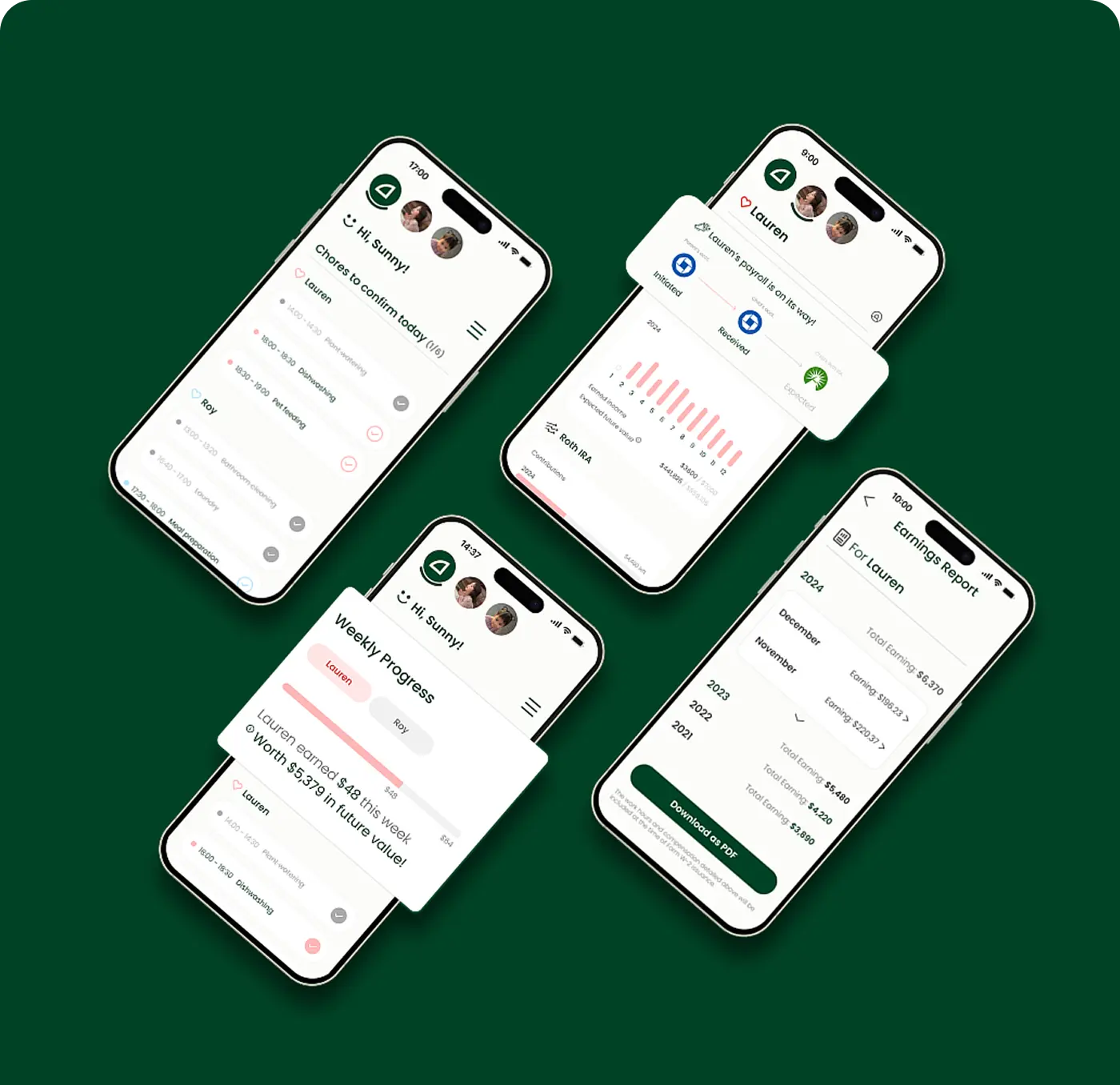

Halfmore is an app enabling parents to use household tasks to open and contribute to their child's Roth IRA.

Everyday Household Tasks → Future Millions? Yes, Really!

Imagine this scenario: Your 7-year-old sweeps the kitchen floor and receives payment for Roblox skins—a reward that vanishes almost immediately. Halfmore offers a compelling alternative. When your child completes household tasks, their compensation can be channeled into their Roth IRA with remarkable growth potential.

Consider the numbers: $7,000 annual contributions between ages 7-17—with no additional investments afterward—could potentially grow to approximately $1.4 million by child's retirement age.

"Most parents believe they're teaching financial responsibility with a piggy bank," notes Halfmore founder Isaac Lee. "Meanwhile, compound interest remains an untapped superpower at their disposal."

Transform everyday household tasks into meaningful wealth-building opportunities for your child's future—while maintaining full compliance and simplicity through our comprehensive platform.

The "Wait, Why Didn't I Think of That?" Moment

Isaac and Jaebum founded Halfmore after discovering a wealth-building strategy used by financially savvy Palo Alto parents during their time at Stanford: hiring their own children—some as young as 5 years old—through family businesses to establish custodial Roth IRAs.

Recognizing that this powerful strategy was out of reach for most Americans without a business or the means to manage costly administrative tasks, they built Halfmore to give all parents the power to help their children build wealth and financial literacy. The platform democratizes household employment, enabling parents to formally hire their children and open Roth IRAs that can grow significantly over time.

Our platform transforms this once-exclusive financial strategy into an opportunity available to every family, regardless of business ownership status or financial expertise.

Real Families, Real "OMG" Results

Case 1: Abrams Family

Before discovering Halfmore, the Abrams family paid their 8-year-old daughter $50 weekly for household chores. This money quickly disappeared on toys and treats, with no lasting financial impact. Like many families, they had no systematic way to convert their child's efforts into long-term wealth.

After implementing Halfmore's platform, the Abrams now properly employ their daughter, contributing $200 monthly to her Roth IRA. This structured approach provides $2,400 in annual tax-advantaged investments. With continued contributions through age 18 and an 8% average annual return, these contributions could potentially grow to ~$1 million by retirement age.

Case 2: Martinez Family

The Martinez family shares a similar experience. Previously, they gave their 11-year-old son irregular cash rewards for helping around the house. Now, through Halfmore's compliant household employment app, their $400 monthly contributions are building a financial foundation that will benefit their child for decades to come. With consistent $400 monthly contributions from age 11 to 18 and an 8% annual return, their son could potentially accumulate ~$1.3 million in his Roth IRA by retirement age.

Why Starting Early Is Essential:

What's particularly striking is how the Abrams family, despite contributing half the monthly amount ($200 vs $400), is able to achieve nearly comparable long-term results simply by the former starting three years earlier. This powerful demonstration of compound interest shows that beginning at age 8 instead of 11 significantly amplifies the impact of each dollar invested, making early adoption of Halfmore a critical factor in maximizing a child's financial future.

Case 3: Patel Family

A trip to the toy store used to end in impulse buys—until the Patels started using Halfmore. On a recent visit, their 10-year-old twins eagerly picked out expensive toys. But instead of reaching for their wallets, the parents pulled out the kids' Halfmore dashboard and said, "You can buy it with your earned money if you'd like."

After seeing how much they had saved—and realizing the toy would cost nearly three weeks' worth of household work—the twins paused. For the first time, they connected effort to value. To their parents' surprise, they put the toys back on the shelf.

Thanks to Halfmore, the Patel kids are learning real-world money decisions early—lessons their parents never expected to happen so soon.

Conclusion

What once seemed accessible only to financially sophisticated families is now helping ordinary parents transform everyday chores into extraordinary wealth-building opportunities for their children's futures.

Start today to take advantage of compound interest for your child's financial future!

Get Started in Less Time Than a Coffee Break

- Download & Choose Plan (3 minutes)

- Add Family Info (5 minutes)

- Assign Household Tasks (7 minutes)

Boom! You've just potentially added seven figures to your child's future.

Halfmore turns everyday household tasks into child's Roth IRA contributions. So while your friends' kids are blowing allowance on slime and balloons, yours are quietly amassing a fortune for your child—all while they are learning to sweep properly.

Now that's what we call cleaning up!